Are you curious about your HRA benefit and how to use it? Click here to learn more.

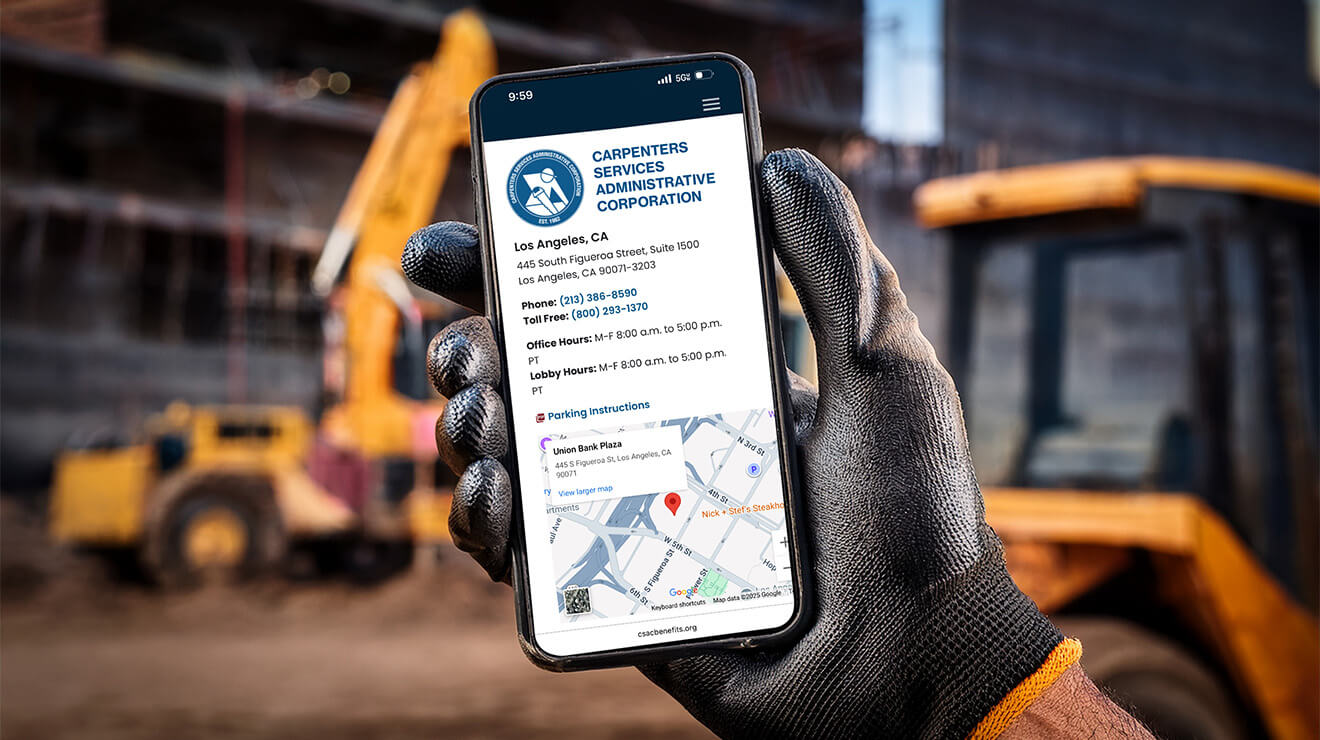

Explore Your Benefits

Retirement

Retirement is not the end of the road; It's the beginning of a new journey.

The Blueprint - Fall 2025

For helpful resources and updates on your benefits, check out the new quarterly benefits newsletter from the Administrative Office.

I Want To...

- locate HIPAA Privacy Notice

- know about Surprise Billing Protections

- download the Participant Information Form

- know how COBRA works

- retire. What do I need to do?

- know how to add and/or drop a dependent.

- learn about new insurance cards from Independence

- access the Southwest Carpenters Reciprocity Form